Policy-makers in Japan have substantially enhanced the Tokyo Stock market, fueling the economic recovery. The question now being asked is, could this pattern be experienced in Europe in the near future?

Japan’s Central Bank is now printing a ton of new money which has devalued the yen and “turned the tide in the war against falling prices.” The problem with this is though that in practice what it will do is push people to put off spending and opt instead to save. That will not be good for the economy.

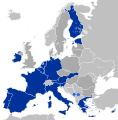

Irrespective of this, Europe is being encouraged to follow Japan’s lead. It has been argued that the only thing that will save the Eurozone now is additional printed Euros. That will guard against deflation and revive the problematic-countries’ economies.

The question on the Japan Euro potential connection now is to review the Japan situation and then to apply it to Europe. The primary goal should be “ending deflation” according to JP Morgan Asset Management analysts.