The USA is one of the world’s largest exporters. Included in this is Asia, specifically Japan with a staggering $134 billion in exports, primarily with cars. South Korea wasn’t far behind with exports totaling $74 billion. Likewise, India’s figure was $46 billion; that region is actually one of the fastest growing exports (mainly in the fields of gemstones, oil and pharmaceuticals).

Tag: Asia

China’s Downfall Impacting Global Economy

There are (justified) concerns that China’s somewhat slowing market is having a negative impact on the world at large. Economies internationally are reacting. In America, for example, the major indices have shut down and a similar trend is being felt in both Asia and Europe.

Here, Christine Lagarde, head of the IMF speaks.

[youtube https://www.youtube.com/watch?v=f82TCsB56Aw&w=560&h=315]

Asian Markets Rise: European’s Plummet

[youtube https://www.youtube.com/watch?v=wg5CpKJVM18]

Canadian-Hong Kong Promo

North America will be host to a promotion event for Hong Kong. ‘Think Asia, Think Hong Kong,’ will be held in Canada on June 8 and Chicago on June 10 is being organized by the Hong Kong Trade Development Council (HKTDC) in order to promote the region as an attractive environment for foreign investments.

North America will be host to a promotion event for Hong Kong. ‘Think Asia, Think Hong Kong,’ will be held in Canada on June 8 and Chicago on June 10 is being organized by the Hong Kong Trade Development Council (HKTDC) in order to promote the region as an attractive environment for foreign investments.

It is anticipated that the two events will attract over 3,000 participants in total. At the event it is hoped that “a unique environment” will be created for Hong Kong businesses to promote their “service excellence to a targeted audience in North America,” according to Margaret Fong, Executive Director at HKTDC. As well, businessmen from the North American region will gain “a fresh perspective” on the benefits of bringing business to Hong Kong.

The event is being supported by over 80 supporting organizations in America and Canada as well as 16 Hong Kong partners.

However, in March trade balance in Hong Kong had an unexpected drop according to the Hong Kong Census and Statistics Department. But still, according to Edith Yeung, an investor who came from the world of entrepreneurship, businessmen and women in Hong Kong should look at China – as opposed to Europe or America – for market expansion.

Fortune Global 500: Asia and America

In a Fortune Global 500 list on the world’s largest companies based on revenue, in an unprecedented move, China came in higher than Japan. Despite this achievement, American firms still took the most positions on the list. Indeed, a staggering 132 companies from the United States were featured, with China as number 2 on the list, featuring 73 companies and Japan with 68.

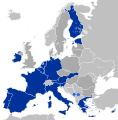

Europe’s Impact

While Europe lost 11 companies in 2011 on the list, China gained 12. Nonetheless, as Fortune pointed out, even though there is a financial crisis in Europe, and Japan has encountered many disasters, the big international companies have continued to escalate in both profit and revenues.

Despite its lead position, America shouldn’t be sitting back on its laurels. The superpower should be aware of the fact that it was the only country to lose so many companies on the list over the last 10 years, having lost 65 headquartered companies throughout that timeframe. In addition, companies in China were showing post-crisis success in 2009, with a move to gas and alternative energy and away from oil. After a hard 2011 vis-à-vis investments, so far 2012 is going well, in America especially, but also noteworthy throughout the world.

East-West Currencies

Clearly connected to all this news is the fact that trading companies are not as enthusiastic about converting the American dollar to the Chinese Yuan. Indeed it is the US dollar that companies want to accumulate since it is strengthening. What happened was, that at the time the Yuan was increasing, rather than buy the US dollar and sell the Yuan to pay for imports, companies would borrow US dollars from banks so as to pay for imports, which shorted the US dollar, which was good since it was anyway the US dollar was weakening. Today the opposite is the case; traders are hanging on to US dollars for longer which impacts China’s monetary condition since its inflows force central bank intervention. China thus finds itself in a strange place, with its domestic economy requiring easier monetary condition but flows leading it in the opposite direction.

Asia’s Economic Success: In Spite of Europe’s Mess

In recent years, although other eastern markets have failed to thrive in debt-ridden European environments, Asia has not been one of them. The region has not encountered nearly as much strife as its neighbors and in fact on the contrary, has enjoyed impressive financial growth. For western businessmen therefore, Asia fares pretty high on the list of possible potential addresses due to less red tape; stable investment opportunities and higher interest rates, especially in countries like Indonesia.

Indeed, Indonesia’s GDP increased by almost 6.50 percent last year which is the highest since the Asian crisis began (and way better than neighboring China and India) and it does not need to depend on global trade flows for success either. Its population is large and growing and its youth has minimal debt and thus greater spending capacity and it offers a huge variety of commodities, being self-sufficient in oil and gas.

Oil Issues

So that’s great for Indonesia. But is this the case throughout the region? Do all eastern markets have so much to offer potential western investors? Perhaps not. Looking at oil prices that are increasing at uncontrollable rapid speeds, Asia’s growth could be shot in the food, making it a rather unattractive place for western businessmen to lay their hats.

In addition, since Asia does not stand alone, both the western world and indeed the global community at large, needs to understand that it will be impacted as well. Should its growth be stumped, this will have a domino effect on Europe and won’t do any favors for America’s recession recovery either. As Tweeter FirstpostMarketsLive noted, “Asia is largest consumer of oil having surpassed North America in 2007 to account for more than 31% of world demand.”

Asia’s economic conglomerates are concerned. Nomura, a multinational conglomerate offering financial services has been taking a stand on the potentially problematic matter. The company’s chief economic advisor, David Resler noted, even though there isn’t as great a threat to a resumption of the financial crisis, this oil price mega increase at the beginning of the year has replaced that threat in as great a severity.

So ultimately there is a lot of optimism out there for potential western investors into Asia. But should the oil price increase crisis not be solved, it could be downhill for not only the entire region, but potentially the whole world. Asia needs to sort this out, and fast.

IT in India Escalates

A recent economic forum held in India concluded that India should be looking towards the possible creation of local jobs outside of the confines of its country. It seems that vis-à-vis keeping jobs at home or away in Asia, there are various schools of thought currently abounding. HCL Technologies for example, believes jobs should be sent out of India, but other companies (like those in the auto and furniture industries), disagree.

At the World Economic Forum Annual Meeting, it was discovered that HCL Tech will be setting up 10,000 jobs within the next five years. But these won’t be in India; the jobs will be located in the West – throughout the United States and Europe. One expert at the Forum pointed out that since globally there are various different economic/business problems, India should look at this conference and see how it can help it out, not hinder it.

Recently, Angela Merkel, the German Chancellor, pointed out that companies should invest in Europe but to do so, jobs need to be created. Thus the HCL initiative will change the view that Indian companies are taking away jobs from people living in the West.

And of course we already know that trends within the Indian IT market are changing significantly, especially vis-à-vis pricing escalation. Thus India’s IT market needs to look at “new growth models” and other available options if it wants to keep up with global movement in the IT market.

America Taking Pride in Economy Again

The US has definitely had its issues with its economy in the last few years. But now it seems that things are looking up, especially when analyzing economic activity over the last year. The country’s S&P 500 Index is said to be doing better than its counterparts in Frankfurt, Hong Kong, Sao Paulo, Shanghai and Tokyo by at least 15 percent. As well, Dow industrials increased 135.63 points on housing and employment. In addition, figures for overall employment are good too with less Americans filing jobless claims.

The Only Way is Up

In truth, things were looking pretty dreary for the American economy a few years ago. It all started to go disastrously wrong in 2007 with the mortgage crisis. Thereafter, there was the plummet in stocks. This was followed by high levels of unemployment, and the collapse of the motor industry. Banks closed, and it seemed at one point that it was becoming almost impossible to hang on to any job. So, truthfully, the situation had no place else to go but up.

Asia Helping America

Today, in 2011-12, America’s economy is definitely going in the right direction. This is in spite of Europe’s debt crisis. Further, since there are now worries about inflation along with a drop in growth in Asia, this is positive for America’s economy too. Japan’s auto industry is suffering somewhat since until recently it was a world leader. This changed due to the overpriced Japanese Yen. But again, this is good news for America as Honda has decided to move four of its manufacturing units out of the country, to America and Mexico. And what this has translated to, is sales of Honda (in America) being just a tad behind those of Korean Hyundai vehicles. Great news for Americans working with Asians leading to the hope of more business deals ahead.

Asia’s High End Art Market

Hong Kong has been instrumental in boosting Asia’s art market over the last few years, especially with its 300 percent increase between 2009-10. This is thanks to the wealthy Chinese who have been enthusiastically purchasing art, resulting in Hong Kong becoming a global art sales center. It seems like art and other alternative investment options – such as wine – have in general been on the rise irrespective of global financial misfortunes such as the collapse of Lehman Brothers three years ago.

Asia’s Rich Getting Richer

It seems that the wealthy individuals in the Asia region are just increasing their financial worth. For example, the region is even beating Europe, standing at $10.7tr., whereas Europe is only up to $10.2tr. Art investment definitely has a lot going for it, being a little different, enjoyable and having pretty good returns. As well what is also good news for Asia is that vis-à-vis the art market, it has not been impacted by the Euro Zone debt crisis. Indeed, the Mei Moses Global Art Index found almost a 12 percent increase in 2011 to November.

One art consultant, Bobby Mohseni, noted, “it may not be a good time for sellers but it's an excellent time for buyers. During late 2008 and 2009, I highly advised clients to buy. With Chinese contemporary art, some prices have gone exceptionally high and that's just over a decade … so it's best to look at upcoming or mid-tier artists.”

In addition, confidence in China’s contemporary art market remains quite high, even though the same confidence is lacking in the European and American counter markets. In other words, Asia does not have to feel the negative impact of what is going on in the western world – as has been seen through its art market.

Asia Playing Big Brother on Euro-Finance Meetings

Europe: Asia Is Watching You

Over the last week there have been a variety of important meetings in Europe over which Asia has been keeping its proverbial Big Brother eye on. Indeed, it may even be somewhat more than just overseeing the progress of the meetings. According to UBS Asia Pacific’s chief investment strategist, Yonghao Pu, “at the moment, we [Asia] are kind of a hostage to what’s going on in Europe.” Due to activities in the global economy, China’s hand is being forced in a way it’s not especially fond of.

Beijing’s Banking

Beijing has had to make some changes. It already removed some of its demands for rural banks and is now doing the same with its major banks, in an effort to facilitate banks giving out loans while offsetting the global economy’s ripple effects.

Beijing has also been quite firm in its insistence that it will not be fishing the Eurozone out of its hole either. As well, due to less demand, there is decreased manufacturing in China. Since Europe is the biggest export market of China, if the region goes into trouble economically, this will negatively impact all Asian exports. Indeed, according to China’s vice minister for foreign affairs, Fu Ying, “the argument that China should rescue Europe does not stand, as reserves are not managed that way.”

The good news for Asia is however, that the region is doing better financially than Europe. Still, it needs to be aware of the fact that when the Eurozone cracks, it could encounter problems too. Keep watching out for Euro meetings to get an idea of what Asia’s next financial step should be.